<<Prev Home PDF Next>>

"David Bonderman of TPG believes that turnaround firms are exactly what failing banks need in order to succeed."

But this NY Times story might give some insights into why Bonderman makes people nervous, most recently in Greece:

Called "Private Equity's Trojan Horse of Debt" by Gretchen Morgenson reports:

WHENEVER savvy private equity firms sell debt in the companies they own, buyer beware.

That's the lesson — learned the hard way — for bondholders in Wind Hellas, a Greek

mobile phone operator whose parent company defaulted on some of its debt payments last November.

A

once-healthy company that is Greece's third-largest mobile phone

operator, Wind Hellas was taken over in a 2005 buyout by two global

private equity giants: Apax Partners out of London and the Texas

Pacific Group, led by David Bonderman.

Before its acquisition, the company had a history of growth and very little debt. After Bonderman et all were

done with Wind Hellas, it had been stripped of its good credit rating

and left for dead, especially after a questionable "certificate payout"

that included a mysterious and temporary spike in the value of those

certificates.

Read the story.

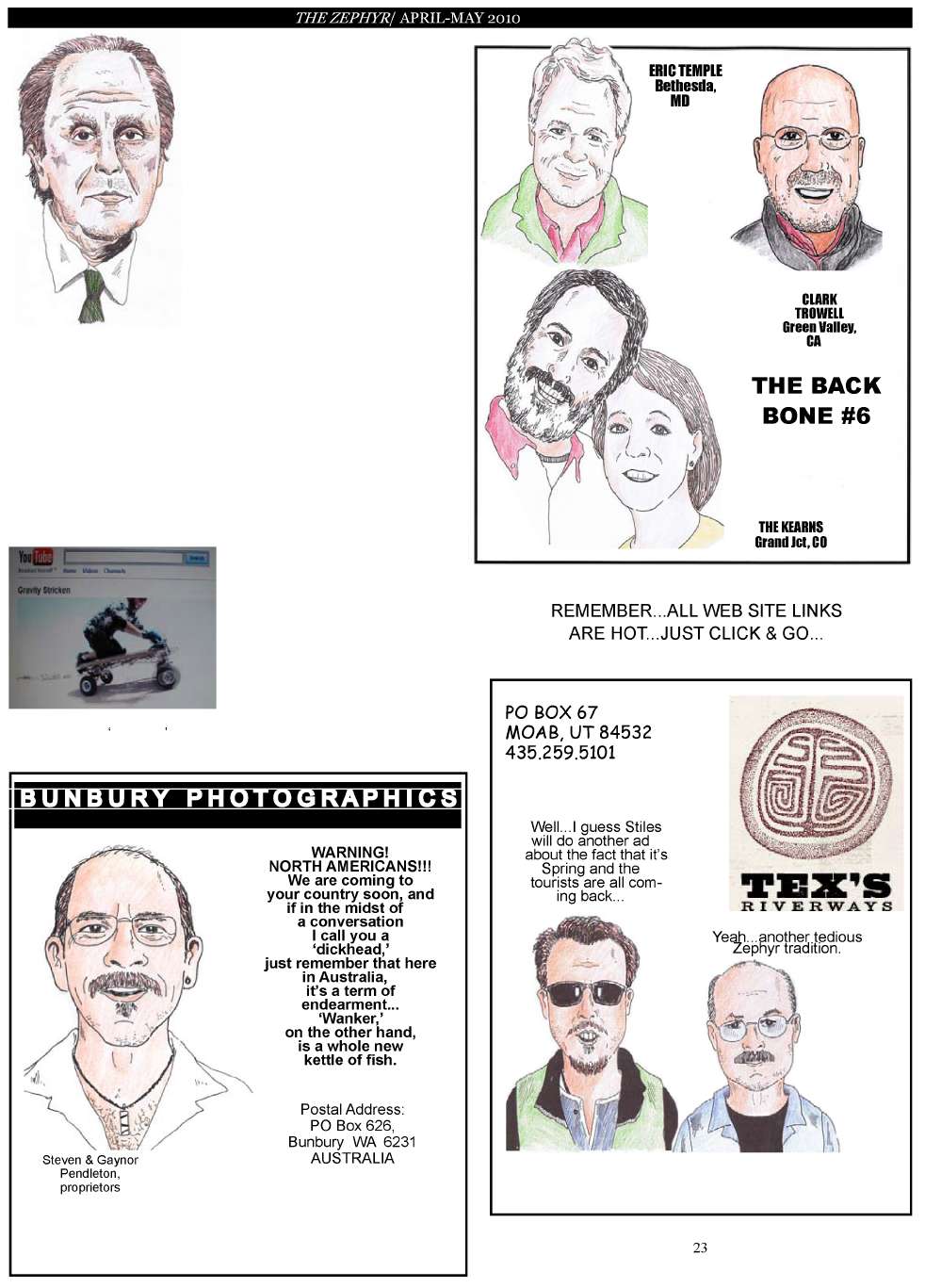

AND FINALLY...NEED AN ESCAPE FROM ALL THIS BULLSHIT?

Moab's

inventor/philosopher Mike Merritt may have just what you need to get

away from it all. Check out his You-Tube video! Mike once sold me a bag

of dehydrrated water and it really worked. But this bit of brilliance

could change the

world...A world of Coasters. Keep dreaming Mike...we need more dreamers.

<<Prev Home PDF Next>>